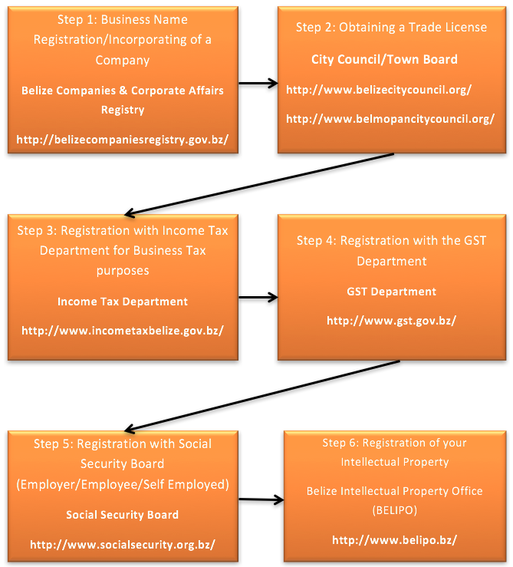

There are 6 steps to formalising a business in Belize:

Step 1: Business name Registration

This is the first step to formalisation of your Business. It is important to protect your business name as yours as this is a key means of identification in the eyes of the target market. This is a one time, one day process undertaken at the Companies & Corporate Affairs Registry located on the Ground Floor of the Garden City Hotel Building in the City of Belmopan. Necessary documents include a valid Social Security card for all owners/partners, and $25. Application forms can be obtained on their website or filled out at the office.

Step 2: Trade License Acquisition

It is important for any person exchanging a good or service for monetary value (operating a business) within an urban area (within the parameters of a town or City) to obtain a trade license to do so. This is obtained at the Town Board or City Council. An application form is filled permission is granted at one of four Quarterly meetings that are held throughout the year. Annual payment is determined through a site visit of the premises at which evaluators determine an annual rental value of the space. Annual trade license fee is usually calculated at 25% of this annual rental value.

Step 3: Income Tax Registration

After registering your business or company and obtaining your trade license, all business must register with the Income Tax Department and Government Sales Tax Department for tax purposes. Upon completion of the registration process at the Income Tax Department, a unique Tax Identification Number (TIN) will be issued. The TIN number is the same number that is to be used for General Sales Tax (GST), Customs and Excise processes.

Business Tax is a tax on total revenues or receipts whether in cash or in kind and whether received or credited without any deduction for expenses. It is payable by any person practicing his profession, or firm carrying on business in Belize, and includes:

In accordance to the Income Tax and Business Tax Act, Chapter 55 (Revised Edition), the tax imposed on a ‘person’ or ‘firm’ is as follows:

Step 4: GST Registration

General Sales Tax is a tax on consumer spending collected at the point of importation and on business transactions when goods changed hands or services are performed. Taxable supplies are taxed at either the standard rate of 12.5% or 0% (Zero-Rated).

All persons who are engaged in a taxable activity with an annual turnover exceeding BZ$75,000.00 must register with the Department of Government Sales Tax in accordance with the Government Sales Tax Act No. 49 of 2005. It is not the business activity which is registered but the person conducting those activities. This person could be a company, partnership, sole proprietorship, trustee or estate. Person must register within one (1) month of the day on which the person first becomes eligible.

Only registered persons can charge GST on their supplies as output tax and claim credit on their purchases of supplies as input tax. (Section 23, GST Act 2005).

Step 5: Social Security Registration

Social Security Act Chapter 44 of Laws of Belize, 1988 revised in 2000-2003 requires that persons who employ one or more persons must register for social security with the Belize Social Security Board. The application must be made with seven (7) days of employing the first employee.

Social Security contribution are made weekly but submitted to the Department with a monthly statement of contributions. The contribution is related to the weekly insurable earnings. A portion of the contribution is paid by the employer and other portion is discounted of the employee salary.

Step 6: Registration /Protection of Intellectual Property

The basis of a business’s identification and an important element of branding, your business’s intellectual property add value to the business and must be protected. Intellectual Property is defined as intangible creations of the mind such as inventions, artistic work, designs, images, symbols, names, etc. that is used in commerce. This registration for protection is done by visiting the Belize Intellectual Property Office located on the second floor of the Habet Building on Constitution Drive in the City of Belmopan. The four areas protected under BELIPO are Trademarks, Patent, Industrial Design, and Copyright.

Step 1: Business name Registration

This is the first step to formalisation of your Business. It is important to protect your business name as yours as this is a key means of identification in the eyes of the target market. This is a one time, one day process undertaken at the Companies & Corporate Affairs Registry located on the Ground Floor of the Garden City Hotel Building in the City of Belmopan. Necessary documents include a valid Social Security card for all owners/partners, and $25. Application forms can be obtained on their website or filled out at the office.

Step 2: Trade License Acquisition

It is important for any person exchanging a good or service for monetary value (operating a business) within an urban area (within the parameters of a town or City) to obtain a trade license to do so. This is obtained at the Town Board or City Council. An application form is filled permission is granted at one of four Quarterly meetings that are held throughout the year. Annual payment is determined through a site visit of the premises at which evaluators determine an annual rental value of the space. Annual trade license fee is usually calculated at 25% of this annual rental value.

Step 3: Income Tax Registration

After registering your business or company and obtaining your trade license, all business must register with the Income Tax Department and Government Sales Tax Department for tax purposes. Upon completion of the registration process at the Income Tax Department, a unique Tax Identification Number (TIN) will be issued. The TIN number is the same number that is to be used for General Sales Tax (GST), Customs and Excise processes.

Business Tax is a tax on total revenues or receipts whether in cash or in kind and whether received or credited without any deduction for expenses. It is payable by any person practicing his profession, or firm carrying on business in Belize, and includes:

- Individuals

- Partnerships

- Companies/Corporations

- Consultants, both local (Resident) and Foreign (Non Resident)

- And any other ‘person’ who is in the business of providing goods and services

In accordance to the Income Tax and Business Tax Act, Chapter 55 (Revised Edition), the tax imposed on a ‘person’ or ‘firm’ is as follows:

- Persons carrying on a trade or business, which earns $75,000.00 or more per annum where such receipts are the only source of livelihood of the person;

- Persons practicing a self-employed profession or vocation, earning $20,000.00 or more per annum where such receipts are the only source of livelihood of the person:

- Persons engaged in the business of investment or earnings form real or personal property:

- Persons engaged in the provision of personal services; including Tour Operators, Travel Agents and other Commission Agents

Step 4: GST Registration

General Sales Tax is a tax on consumer spending collected at the point of importation and on business transactions when goods changed hands or services are performed. Taxable supplies are taxed at either the standard rate of 12.5% or 0% (Zero-Rated).

All persons who are engaged in a taxable activity with an annual turnover exceeding BZ$75,000.00 must register with the Department of Government Sales Tax in accordance with the Government Sales Tax Act No. 49 of 2005. It is not the business activity which is registered but the person conducting those activities. This person could be a company, partnership, sole proprietorship, trustee or estate. Person must register within one (1) month of the day on which the person first becomes eligible.

Only registered persons can charge GST on their supplies as output tax and claim credit on their purchases of supplies as input tax. (Section 23, GST Act 2005).

Step 5: Social Security Registration

Social Security Act Chapter 44 of Laws of Belize, 1988 revised in 2000-2003 requires that persons who employ one or more persons must register for social security with the Belize Social Security Board. The application must be made with seven (7) days of employing the first employee.

Social Security contribution are made weekly but submitted to the Department with a monthly statement of contributions. The contribution is related to the weekly insurable earnings. A portion of the contribution is paid by the employer and other portion is discounted of the employee salary.

Step 6: Registration /Protection of Intellectual Property

The basis of a business’s identification and an important element of branding, your business’s intellectual property add value to the business and must be protected. Intellectual Property is defined as intangible creations of the mind such as inventions, artistic work, designs, images, symbols, names, etc. that is used in commerce. This registration for protection is done by visiting the Belize Intellectual Property Office located on the second floor of the Habet Building on Constitution Drive in the City of Belmopan. The four areas protected under BELIPO are Trademarks, Patent, Industrial Design, and Copyright.