The Economic Partnership Agreement (EPA) is an establishment between CARIFORUM (Member states of CARICOM and the Dominican Republic) states and the 27 member states of the European Union for reciprocal (two-way) trade signed on the 16th day of December 2007.

The objective of this agreement is to contribute to the reduction and eventual eradication of poverty, promote regional integration, economic cooperation and good governance.

This agreement was negotiated under four technical negotiating groups:

EPA contains a strong development component with clear links to development aid for adjustment and modernization of CARIFORUM economies. It grants CARIFORUM States considerable concessions in market access for both good and services. Products originating in the CARIFORUM States shall be imported duty free into the European Community. In addition to expanding its exports of goods and service, the EPA also provides investment opportunities to private sector in CARIFORUM.

The objective of this agreement is to contribute to the reduction and eventual eradication of poverty, promote regional integration, economic cooperation and good governance.

This agreement was negotiated under four technical negotiating groups:

- Market access

- Services and investment

- Trade related issues

- Legal and institutional issues

EPA contains a strong development component with clear links to development aid for adjustment and modernization of CARIFORUM economies. It grants CARIFORUM States considerable concessions in market access for both good and services. Products originating in the CARIFORUM States shall be imported duty free into the European Community. In addition to expanding its exports of goods and service, the EPA also provides investment opportunities to private sector in CARIFORUM.

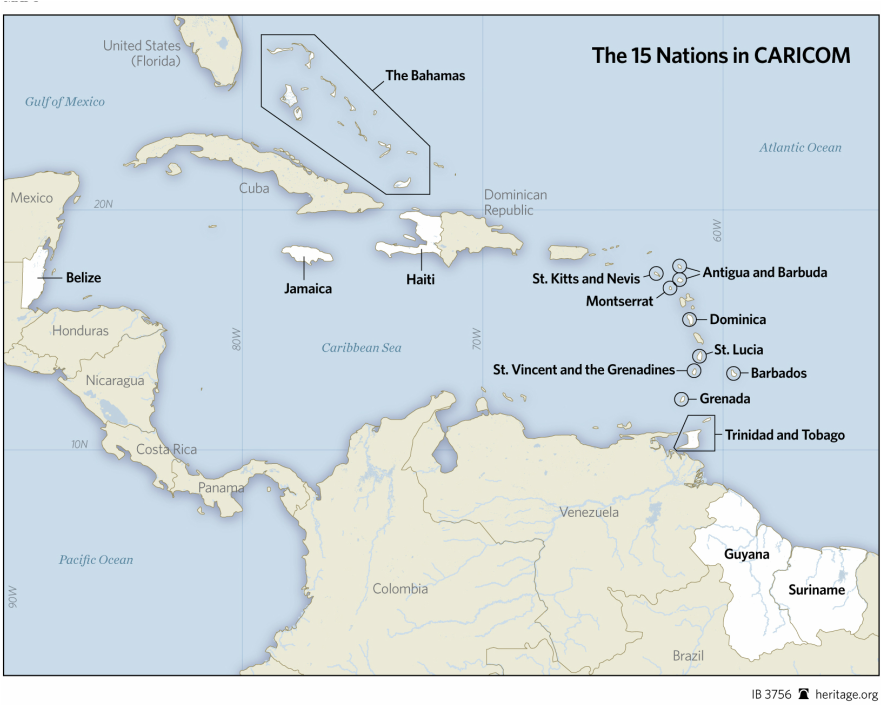

The Revised Treaty of Chaguaramas establishing the Caribbean Community and the CARICOM Single Market and Economy (CSME) signed in 2001, governs trade relations in CARICOM. CSME allows the free movement of SERVICES, GOODS, PEOPLE and CAPITAL across the Member States of the Caribbean Community, by removing all barriers to trade and impediments which could restrict one’s right to provide services.

The agreement facilitates the following:

The agreement facilitates the following:

- Removal of import duties, tariffs and quantitative restrictions for all goods of CARICOM origin.

- Access to land, building and other property related to the provision of services by nationals from other Member states without any limitations or discrimination.

- Travel of University Graduates, Media Workers, Sports Persons, Musicians, Artists, Managers, Supervisors and other service providers to Member States with only a travel permit, and in some cases an Inter-Caribbean Travel document. Workers in these categories can move freely to another Member State and enjoy the same benefits and rights regarding condition of work and employment and property access for either residential or business purposes.

- Equal rights of citizens of Member States to buy shares in any company of any Member State and to remove capital from one Member State to another.

- Right to transfer money form one member state to another country through bank notes, cheques, electronic transfers, etc., without having prior authorization.

- Removal of restrictions to encourage intra-regional investments.

The Partial Scope Agreement (PSA) is an agreement between the Government of Belize and the Government of the Republic of Guatemala signed on the 26th day of June 2006. A PSA is a reciprocal (two way) trade on a small number of goods

The objective of this agreement is to strengthen the commercial and economic relations between the Parties through:

Reference

The objective of this agreement is to strengthen the commercial and economic relations between the Parties through:

- The facilitation, promotion, diversification and expansion of trade in originating goods from the parties

- Development of mechanisms for the promotion of investments

- The establishments of a legal framework

- Facilitation of the land transportation of goods

- The establishment of an efficient, transparent and effective system to resolve trade disputes

- Orange juice (spirited, sweetened or frozen)

- Red kidney beans

- Fresh fish

- Livers and roes, frozen shrimps and prawns

- Meat

- Aquatic invertebrates

- Crustaceans

- Live poultry

- Live swine

- Maize (corn)

Reference

- Partial Scope Agreement Between the Government of Belize and the Government of the Republic of Guatemala

The Caribbean Basin Initiative (CBI) was an independent program in the United States of America that was initiated by The Caribbean Basin Economic Recovery Act of 1983 (CBERA). CBERA provides duty free entry of textile goods and certain non-textile goods into the United States from designated beneficiary countries. However, CBERA was later expanded in 2000 to the U.S-Caribbean Basin Trade Partnership Act of 2000 (CBTPA), which also provides duty free entry of textile and certain non-textile goods into the United States. Collectively, these two acts are known as the Caribbean Basin Initiative which is a vital element in United States economic relations, intended to facilitate the economic development and export diversification with Central America and the Caribbean. It also aims to expand foreign and domestic investment in non-traditional sectors, thus expanding their exports. Central America and the Caribbean will continue to export under the CBI until September 30th, 2020.

There are twenty-four (24) beneficiary countries under the CBI, inclusive of:

Products eligible for duty free entry into the United States and Caribbean Basin Companies under the CBI are as follows:

Products are deemed eligible for CBI duty-free treatment if the following conditions are met:

In addition, the cost or value of materials produced in the customs territory of the United States (other than Puerto Rico) may be counted, but only to a maximum of 15% of the appraised value of the imported article. The cost or value of materials imported into a beneficiary country from a non-beneficiary country may be included in calculating the 35% value-added requirement for an eligible article, if the materials are first substantially transformed into new and different articles of commerce and are then used as constituent materials in the production of the eligible article.

There are twenty-four (24) beneficiary countries under the CBI, inclusive of:

- Antigua and Barbuda

- Aruba

- Bahamas

- Barbados

- Belize

- British Virgin Islands

- Costa Rica

- Curacao

- Dominica

- Dominican Republic

- El Salvador

- Grenada

- Guatemala

- Guyana

- Haiti

- Honduras

- Jamaica

- Montserrat

- Netherlands Antilles

- Panama

- St. Kitts and Nevis

- St. Lucia

- St. Vincent and the Grenadines

- Trinidad and Tobago

Products eligible for duty free entry into the United States and Caribbean Basin Companies under the CBI are as follows:

- Electronic and electro- mechanical assembly

- Handicrafts, giftware, and decorative accessories

- Wood products, including furniture and building materials

- Recreational items such as, sporting goods and toys

- Fresh and frozen seafood

- Tropical fruit products and winter vegetables

- Ethnic and specialty foods, such as, sauces, spices, liqueurs, jams and confectionary items

- Ornamental horticulture

- Medical and surgical supplies

Products are deemed eligible for CBI duty-free treatment if the following conditions are met:

- The merchandise must be imported directly from a beneficiary country into the customs territory of the United States.

- The merchandise must have been produced in a beneficiary country. This requirement is satisfied when (a) goods are wholly the growth, product, or manufacture of a beneficiary country or (b) the goods have been substantially transformed into a new and different article of commerce in a beneficiary country, as determined by U.S. Customs.

- At least 35% of the appraised value of the article imported into the United States must consist of the cost or value of materials produced in one or more beneficial countries and/or the direct costs of processing operations performed in one or more beneficiary countries. The Commonwealth of Puerto Rico and the U.S. Virgin Islands are defined as beneficiary countries for purposes of this requirement; therefore, value attributed to Puerto Rico or the Virgin Islands may also be counted.

In addition, the cost or value of materials produced in the customs territory of the United States (other than Puerto Rico) may be counted, but only to a maximum of 15% of the appraised value of the imported article. The cost or value of materials imported into a beneficiary country from a non-beneficiary country may be included in calculating the 35% value-added requirement for an eligible article, if the materials are first substantially transformed into new and different articles of commerce and are then used as constituent materials in the production of the eligible article.