Friendly Tax Regime

The Government of Belize (GOB), recognized by investors as supportive and predictable, is wholly committed to creating the conditions, policies, and institutions to continue supporting the country’s niche-oriented development model and preserving the country’s distinctiveness. In addition, Belize offers a business-friendly tax regime with low. Below is a list of taxes payable to the Government of Belize.

Business Tax

Businesses, companies, and self-employed persons earning in excess of BZ$75,000 per annum must pay business tax. The rate varies according to business classification, as demonstrated by the table below. Business tax is paid monthly to the Income Tax Department.

| Business Classification | Rate of Business Tax |

|---|---|

| Professional Services | 6.0% |

| Commissions and Royalties | 5.0% & 15.0% |

| Rental Income | 3.0% |

| Radio, On-air TV, and Newspaper Revenue | 0.75% |

| Domestic Airline Revenue | 1.75% |

| Insurance Institutions General Revenue> | 1.75% |

| Telecommunications Revenue | 19.0% |

| Fuel/Lubricant Revenue | 0.75% |

| Casino and Gaming Revenue | 4.0% |

| Real Estate Business | 15.0% |

| Tour Operators & Travel Agents | 6.0% |

Belize Tax Service

Belize Tax Service

Address:

305 Chetumal Street

Belize City

Belize

TEL: 501 222-4776, 501-222-4956

https://bts.gov.bz/

Belize Tax Service

Address:

305 Chetumal Street

Belize City

Belize

TEL: 501 222-4776, 501-222-4956

https://bts.gov.bz/

Income Tax

Income Tax is payable at a rate of 25% on taxable income for all employed persons resident in Belize earning over BZ$26,000 (US$13,000) per annum; persons earning less than this are exempted from the tax. The basic allowance is BZ$25,600 (US$12,800). This is also known as the PAYE tax, and is only applicable to employees’ income, and is not classified as a cost to be borne by the employer or business.

For further information, kindly contact the Income Tax Department:

Address: 305 Chetumal Street

Belize City

Belize

Tel: 501 222-4776, 501-222-4956

Website: https://bts.gov.bz

For further information, kindly contact the Income Tax Department:

Address: 305 Chetumal Street

Belize City

Belize

Tel: 501 222-4776, 501-222-4956

Website: https://bts.gov.bz

General Sales Tax

The General Sales Tax (GST) is a consumer tax applied at a rate of 12.5% on goods and services in Belize; some basic goods and services, however, are zero-rated while others are exempt. The tax is imposed on the mark-up value of goods and services and is payable monthly to the Department of GST. Only registered persons can charge GST on their supplies as output tax and claim credit on their purchases of supplies as input tax. If you are conducting a taxable activity and your annual turnover exceeds $75,000 (US$37,500), you will need to register for GST by applying to the Department of GST.

For further information, kindly contact the GST Department:

Charles Barlett Hyde Building

Mahogany Street Extension

Belize City

Belize, Central America

Tel: +501-222-5574 or +501-222-5579

Fax: +501-222-5513

Email: [email protected]

Website: www.gst.gov.bz

For further information, kindly contact the GST Department:

Charles Barlett Hyde Building

Mahogany Street Extension

Belize City

Belize, Central America

Tel: +501-222-5574 or +501-222-5579

Fax: +501-222-5513

Email: [email protected]

Website: www.gst.gov.bz

Hotel Tax

Businesses operating in the hotel industry are also required to levy an additional hotel tax of 9%. The tax is charged to the hotel guests and paid monthly to the Belize Tourism Board (BTB).

For further information kindly contact the Belize Tourism Board:

P.O. Box 325

#64 Regent Street

Belize City

Belize, Central America

Tel: +501-227-2420 or +501-227-2417

Fax: +501-227-2423

Toll-Free: 1-800-624-0686

Website: www.travelbelize.org

[email protected]

For further information kindly contact the Belize Tourism Board:

P.O. Box 325

#64 Regent Street

Belize City

Belize, Central America

Tel: +501-227-2420 or +501-227-2417

Fax: +501-227-2423

Toll-Free: 1-800-624-0686

Website: www.travelbelize.org

[email protected]

Environmental Tax

Environmental Tax is charged on the C.I.F. (Cost, Insurance, and Freight) value of goods imported into Belize at a rate of 3%. Certain medicines and medicinal supplies for human use along with basic foodstuffs, such as rice, beans, potatoes, coffee, tea, butter and butter substitutes, cheese, margarine, cooking oil, shortening, lard and lard substitutes, milk (in powder form), condensed milk, baby formula, sardines, meat of swine salted or in brine, corned beef, and salt are exempt. Goods made available from funds provided through grant agreements with external donor agencies, funds borrowed from external financial institutions by the Government of Belize, or through a government guarantee are also exempt from paying this tax. The tax is payable at the time of importation and is the liability of the importer.

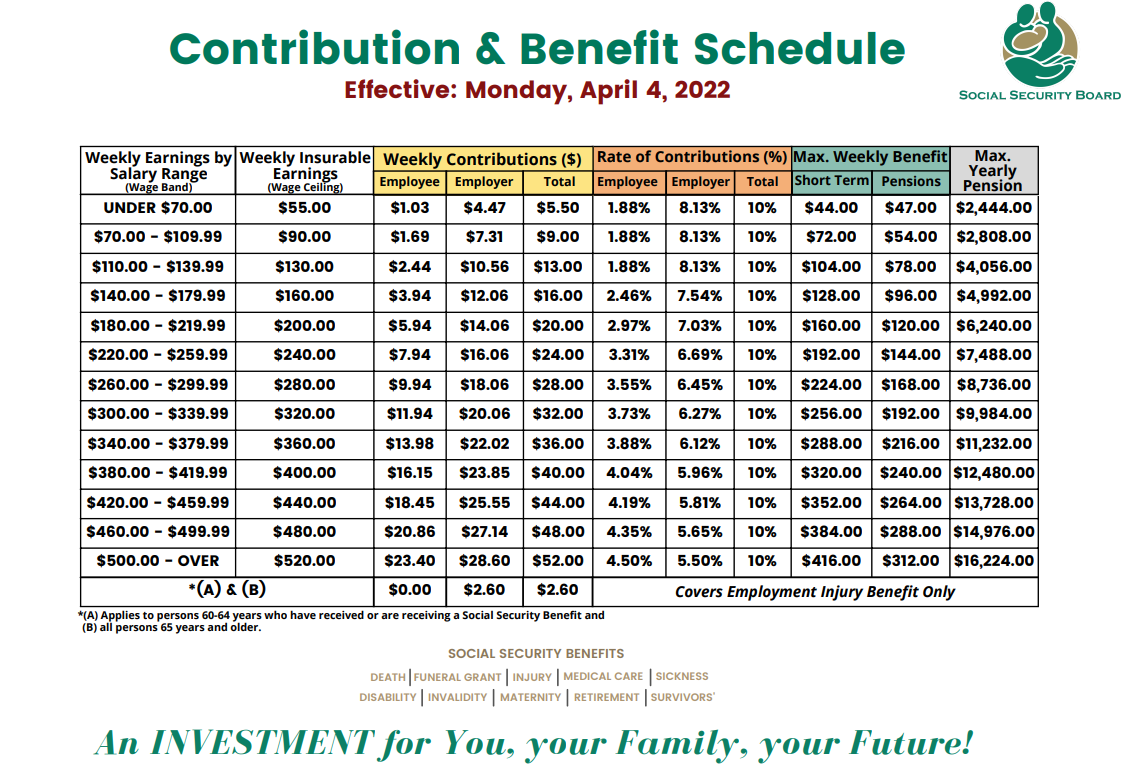

Social Security Contributions

Social Security provides benefits for employed persons in cases of sickness, maternity, injury, or disability. These payments are to be filed and paid monthly to the Belize Social Security Board. Each employer must ensure that employees are in possession of a valid social security card prior to hiring.

The table below illustrates weekly contributions to the fund.

The table below illustrates weekly contributions to the fund.

For further information, kindly contact the Social Security Board:

For further information, kindly contact the Social Security Board:

P.O. Box 18

Bliss Parade

City of Belmopan

Cayo District

Belize

Tel: +501-822-2163 or +501-822-2471

Website: www.socialsecurity.org.bz

P.O. Box 18

Bliss Parade

City of Belmopan

Cayo District

Belize

Tel: +501-822-2163 or +501-822-2471

Website: www.socialsecurity.org.bz

Land Tax

This tax is collected by the Department of Lands, and is assessed at a rate of 1% of the unimproved value of the land. The table below details values for each district.

The table below details values for each district:

The table below details values for each district:

|

Declared Unimproved Values per Acre (by District) |

|||||

|

Categories |

Corozal & Orange Walk |

Cayo |

Belize |

Stann Creek |

Toledo |

|

Agricultural |

|||||

|

30 acres or less |

100.00 |

100.00 |

100.00 |

100.00 |

50.00 |

|

31 to 300 Acres |

500.00 |

550.00 |

600.00 |

500.00 |

100.00 |

|

301 acres or more |

600.00 |

650.00 |

700.00 |

600.00 |

300.00 |

|

Non Agricultural |

|||||

|

Suburban |

1,000.00 |

1,000.00 |

1,500.00 |

700.00 |

500.00 |

|

Beaches and Cayes |

10,000.00 |

N/A |

10,000.00 |

10,000.00 |

5,000.00 |

|

Village lots (1 acre or less) |

1,000.00 |

1,000.00 |

1,000.00 |

1,000.00 |

500.00 |

Ministry of Natural Resources

H.M Queen Elizabeth II Blvd

City of Belmopan

Cayo District

Belize

501-822-0667, 501-880-0667

[email protected]

Stamp Duty/Transfer Tax

Stamp duty, also called transfer tax, is payable on any transaction involving taxable land. This Duty is payable to the Government of Belize at the rate of 5% of the value of the land for Belize and CARICOM nationals. Once the land value is more than 20,000.00. Any other person is charged stamp duty at a rate of 8% of the value of the land.

Property Tax

Property tax is levied and controlled by City Councils and Town Boards in each district. Within the City of Belmopan, the rate of property tax is set at 2% of the assessed value; the Belize City Council utilizes the rate of 2.5% of the assessed value.

Excise Tax

The Excise Tax is collected on locally manufactured alcohol, beer, cigarettes, and soft drinks. Excise tax is levied on certain classifications of imported vehicles.

Import Duty & Revenue Replacement Duty

The Belize Customs Tariff is modelled from the Harmonized Description and Coding System (HS). The rates are based on the Customs Value (Cost, Insurance, Freight – CIF).

Import Duties are levied at the point of importation and is the liability of the importer. The Belize Customs & Excise Department is responsible for the collection of import duties. Rates range from 0 to 45% with most commodities attracting a rate of 20%.

There are some items that attract a Revenue Replacement Duty (RRD) ranging from 5%- 40% based on the aggregate of the Customs Value and the Import Duties. For the complete list of commodities attracting RRD visit the Belize Customs & Excise Department’s website Visit site

Under the CARICOM agreement, all imported products entering Belize from a CARICOM member state are exempt from import duties. To receive an exemption, importers must produce a CARICOM Certificate of Origin to the Comptroller of Customs. Customs brokerage services are necessary when importing goods.

For further information regarding Import Duty, Revenue Replacement Duty and Excise Tax, kindly contact the Belize Customs and Excise Department:

Belize Customs and Excise Department

Customs House

Port Loyola,

P.O. Box 146,

Belize City

Belize

Telephone: +501-223-7092/93

Fax: +501-223-7091

E-mail: [email protected]t

Import Duties are levied at the point of importation and is the liability of the importer. The Belize Customs & Excise Department is responsible for the collection of import duties. Rates range from 0 to 45% with most commodities attracting a rate of 20%.

There are some items that attract a Revenue Replacement Duty (RRD) ranging from 5%- 40% based on the aggregate of the Customs Value and the Import Duties. For the complete list of commodities attracting RRD visit the Belize Customs & Excise Department’s website Visit site

Under the CARICOM agreement, all imported products entering Belize from a CARICOM member state are exempt from import duties. To receive an exemption, importers must produce a CARICOM Certificate of Origin to the Comptroller of Customs. Customs brokerage services are necessary when importing goods.

For further information regarding Import Duty, Revenue Replacement Duty and Excise Tax, kindly contact the Belize Customs and Excise Department:

Belize Customs and Excise Department

Customs House

Port Loyola,

P.O. Box 146,

Belize City

Belize

Telephone: +501-223-7092/93

Fax: +501-223-7091

E-mail: [email protected]t